Why some insurers decline while others accept

Why some insurers decline while others accept is one of the most common questions Australians ask once they actually apply for life insurance. And usually, it comes after a confusing moment. One insurer says no. Another says yes. A third says yes, but only with conditions.

Same person. Same health history. Totally different outcomes.

And the short answer is this: underwriting is not one-size-fits-all, and it’s not random either.

Let’s break down what’s really happening behind the scenes, especially if you’re coming off the holiday break with a new injury, a medical diagnosis, or just finally getting around to sorting your cover.

“Every insurer has a different underwriting manual. The same medical condition can be assessed completely differently depending on who you apply with.”

What underwriting actually is (and why it matters)

Insurance underwriting is the process insurers use to decide whether they’ll offer you cover, and if so, on what terms. That includes whether your policy is issued at standard rates, with a higher premium called a loading, with exclusions, or declined altogether.

This is where why some insurers decline while others accept really starts to make sense.

Every insurer operates under its own underwriting rules. These rules determine how conditions like asthma, back pain, mental health history or diabetes are treated. And those rules are not uniform across the market.

The reinsurer factor most people never hear about

One of the biggest reasons underwriting outcomes differ is something most consumers never see: reinsurers.

Reinsurers are global institutions that sit behind Australian insurers and absorb much of the financial risk. Different reinsurers have different data, different claims experiences, and different tolerance levels for certain medical conditions.

In the Skye deep dive, Phil and Natalia explained that some insurers retain more risk internally, while others outsource a larger portion to reinsurers. That split directly impacts flexibility.

Some insurers can make exceptions. Others must follow reinsurer rules almost to the letter.

“A lot of reinsurance data comes from the US and Europe. That doesn’t always reflect Australian health outcomes.”

Why the same condition can get three different answers

This is where things get practical.

A condition like controlled asthma might be viewed as low risk by one insurer that’s seen minimal claims from it. Another insurer, working with different data, may apply an exclusion or even decline cover entirely.

Mental health history is another area where outcomes vary widely.

According to the Australian Institute of Health and Welfare, one in five Australians experiences a mental health condition each year. Yet underwriting responses still differ significantly depending on severity, recency, treatment history and insurer rules.

This explains why some insurers decline while others accept, even when applicants feel their condition is well managed.

Exclusions vs loadings (and why neither is automatically bad)

When insurers don’t issue standard cover, they usually take one of two approaches.

An exclusion removes claims related to a specific condition. A loading keeps full cover but increases the premium.

Which one is better depends on the person, their risk profile, and what they’re most likely to claim on. For example, a loading might make sense for an old injury that no longer affects daily life, while an exclusion may be more appropriate where recurrence risk is high.

APRA data shows that musculoskeletal conditions and mental health claims remain among the most common causes of income protection claims in Australia. This is why these areas receive the most underwriting scrutiny.

Guaranteed renewable policies change everything

One reason insurers are conservative at application stage is because retail life insurance is usually guaranteed renewable.

Once your policy is issued, insurers cannot cancel it or change your terms because your health worsens. They assess everything upfront, lock in the terms, and then carry that risk for decades.

That’s a big deal.

It’s also why insurers want as much clarity as possible before they say yes.

“They assess you as you are today, with all current and past medical history, because they don’t get another chance later.”

Why the same application can get completely different outcomes

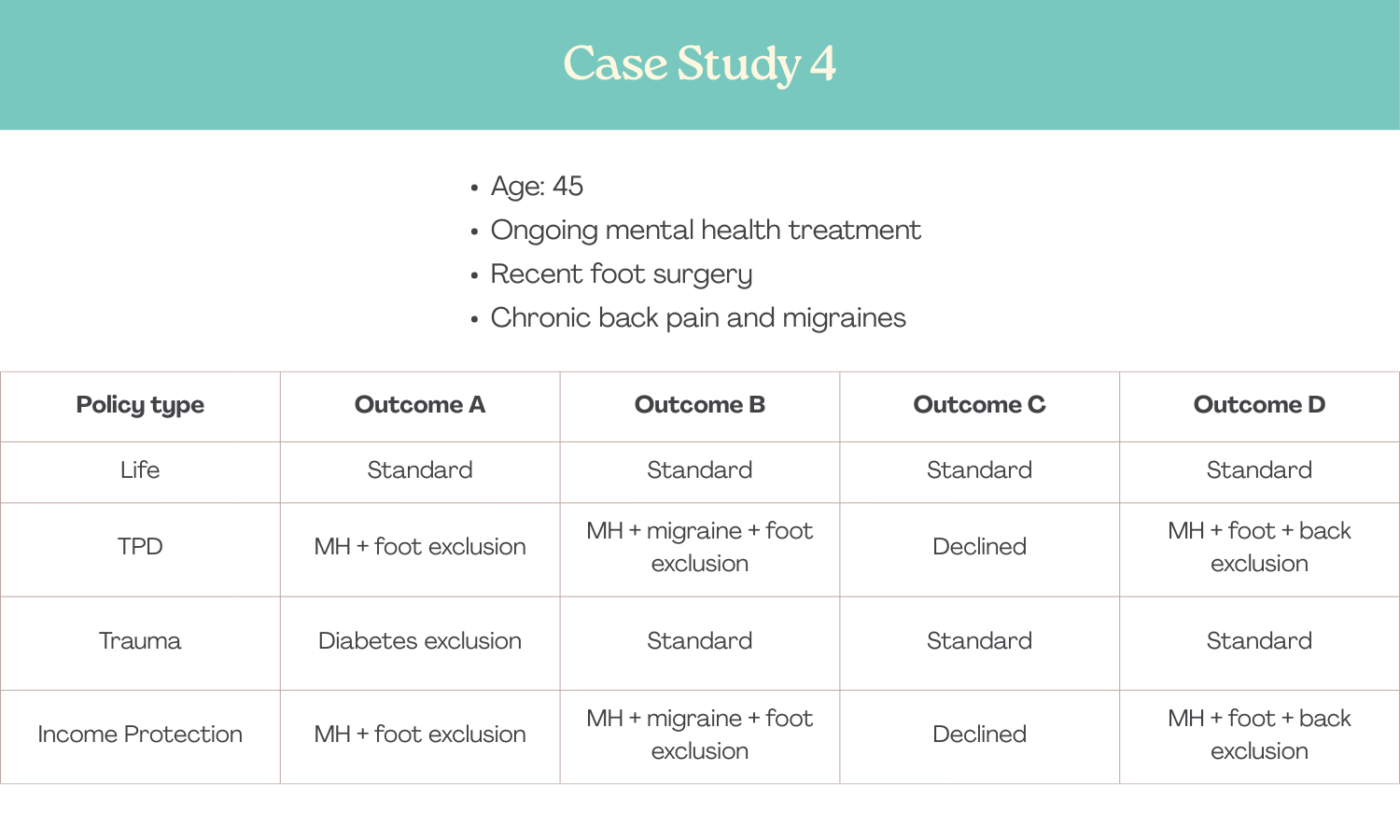

It surprises many people to learn that the exact same insurance application can be assessed in very different ways.

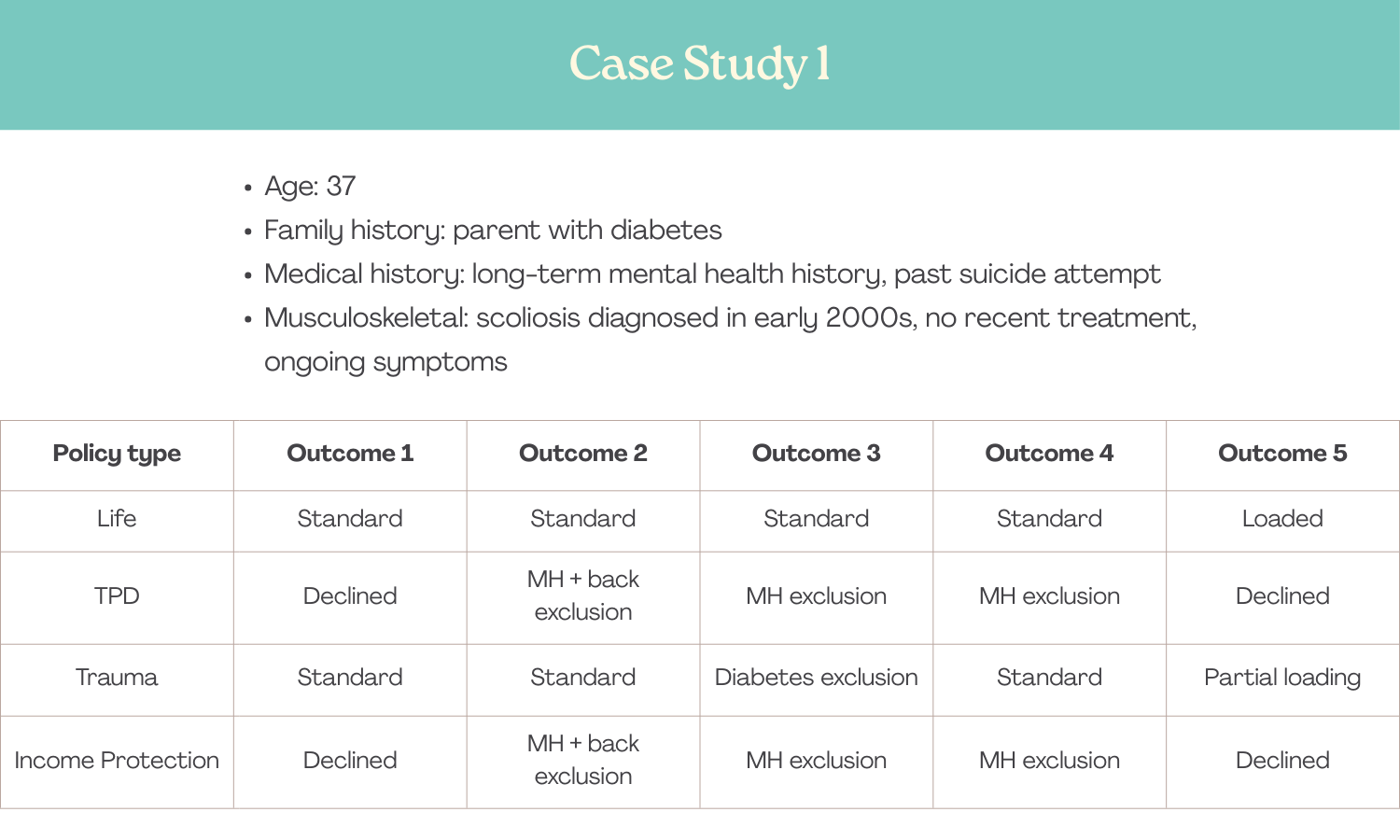

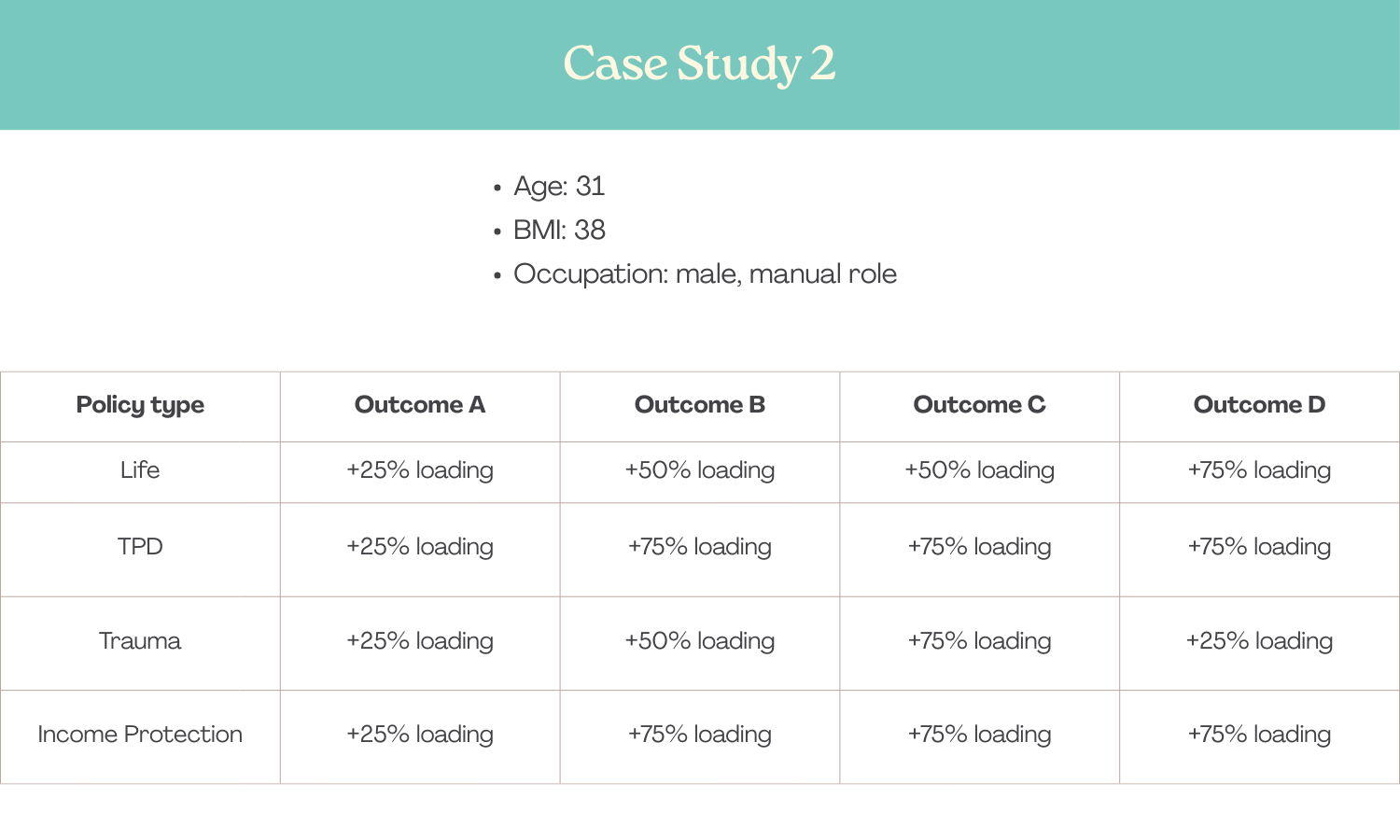

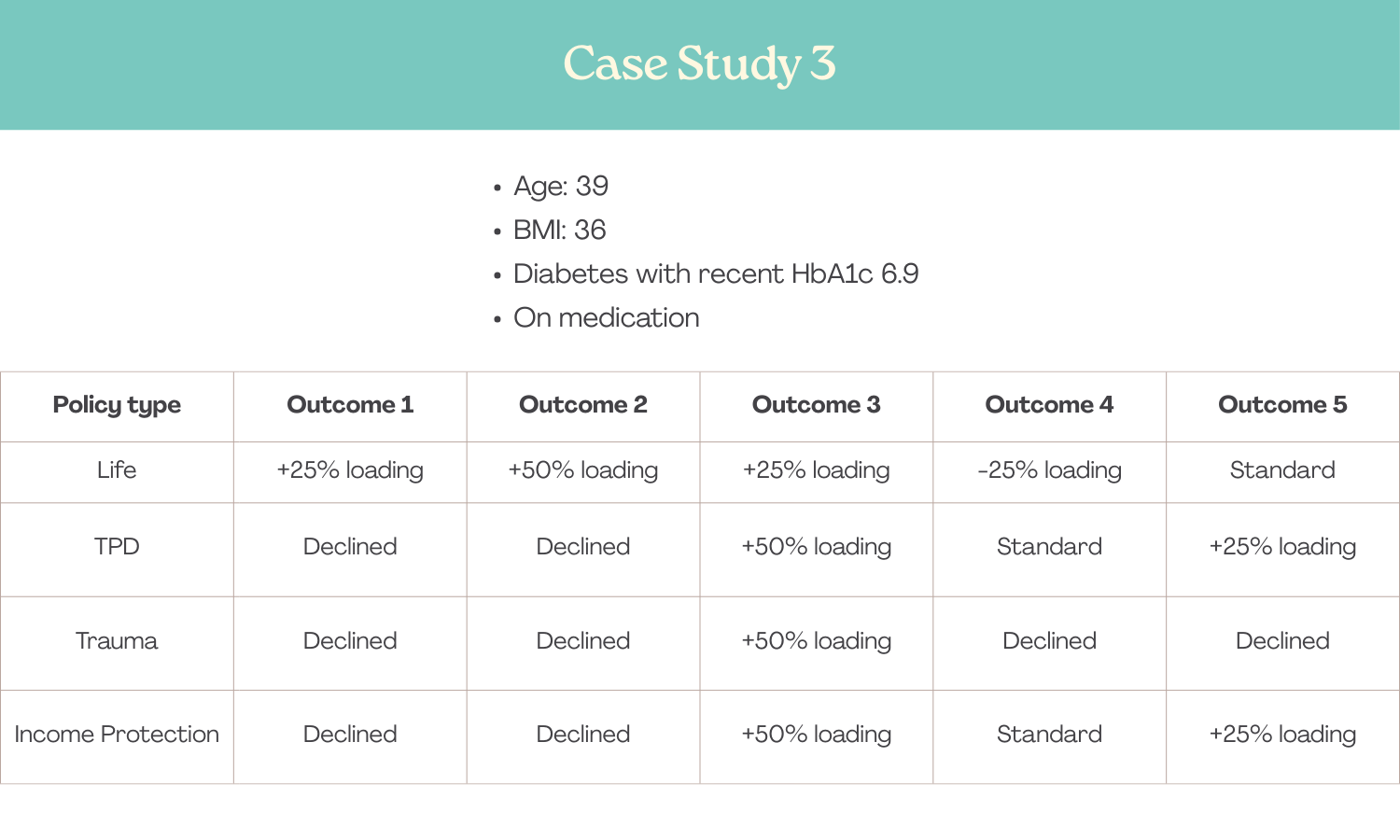

Looking at a series of anonymised real-world assessments, the outcomes varied widely. Some applications were accepted on standard terms. Others came back with targeted exclusions across disability policies. A few were declined outright.

In one example, a client with long-standing but stable medical conditions was assessed by multiple insurers and received five different outcomes.

One assessment resulted in standard cover with only minor exclusions.

Another assessment declined several policy types altogether.

The remaining outcomes landed somewhere in between.

Nothing about the client changed.

Their medical history stayed the same.

Their disclosures stayed the same.

What changed were the insurer rules.

Each insurer applies its own underwriting guidelines, risk thresholds and reinsurance arrangements. Those internal differences are enough to shift an outcome from standard cover to exclusions, or from exclusions to a decline.

This is why some insurers decline while others accept. And it is why applying without understanding insurer appetite can lead to avoidable declines, unnecessary exclusions or paying more than you need to for cover that could have been assessed differently elsewhere.

5 common conditions with very different outcomes

These examples are drawn from real adviser-led assessments. Insurers have been removed to keep the focus on outcomes, not brands.

Mental health (recent or historical treatment)

Possible outcomes include:

Decline where treatment is recent or ongoing

Standard cover with a mental health exclusion

Standard cover where symptoms are low severity and stable

The Life Insurance Code of Practice requires underwriting decisions to be fair, evidence-based and individual. Recent reviews have criticised blanket mental health exclusions, but practice still varies widely between insurers.

Back pain or musculoskeletal conditions

Outcomes may include:

Broad musculoskeletal exclusions

Targeted exclusions relating only to the affected area

Premium loadings

Declines where symptoms are ongoing or duties are highly physical

Key drivers include recency, imaging results, time off work and whether the role is manual or sedentary.

Type 2 diabetes

Possible outcomes range from:

Decline

Standard cover with diabetes-related exclusions

Modest premium loadings where control is strong and recent blood results are favourable

Why pre-assessment matters more than people realise

During the session, Phil and Natalia walked through multiple anonymised case studies. The outcomes ranged from full standard cover, to exclusions across disability policies, to outright declines.

In one example, a client with long-standing but stable conditions received five different outcomes across insurers. One offered standard cover with minimal exclusions. Another declined multiple policy types outright.

This wasn’t because the client changed. It was because the insurer rules did.

This is exactly why some insurers decline while others accept, and why applying blindly can lead to frustrating results.

Post-holiday injuries and insurance timing

January is one of the busiest periods for insurance conversations. Holiday sports injuries, accidents, flare-ups of old conditions and new diagnoses are common.

According to Safe Work Australia, musculoskeletal injuries spike after holiday periods due to increased activity and return-to-work strain.

If you’re applying for insurance after an injury, timing and insurer selection matter more than ever. A recent injury might trigger an exclusion with one insurer, while another may take a more flexible view depending on recovery evidence.

The real takeaway

Why some insurers decline while others accept isn’t about luck. It’s about underwriting philosophy, reinsurer influence, data sources, and how risk is shared.

Insurance decisions are complex, and outcomes vary because insurers are genuinely different businesses with different appetites for risk.

Understanding that difference is what turns insurance from a frustrating guessing game into a strategic decision.

Resources

Australian Prudential Regulation Authority (APRA)

Australian Institute of Health and Welfare

Safe Work Australia

Life Insurance Code of Practice (CALI)