Understanding Defined Benefit Super: What it means for your insurance and retirement plan

Ever looked at your super and thought, "What the heck is a defined benefit fund?" You're not alone.

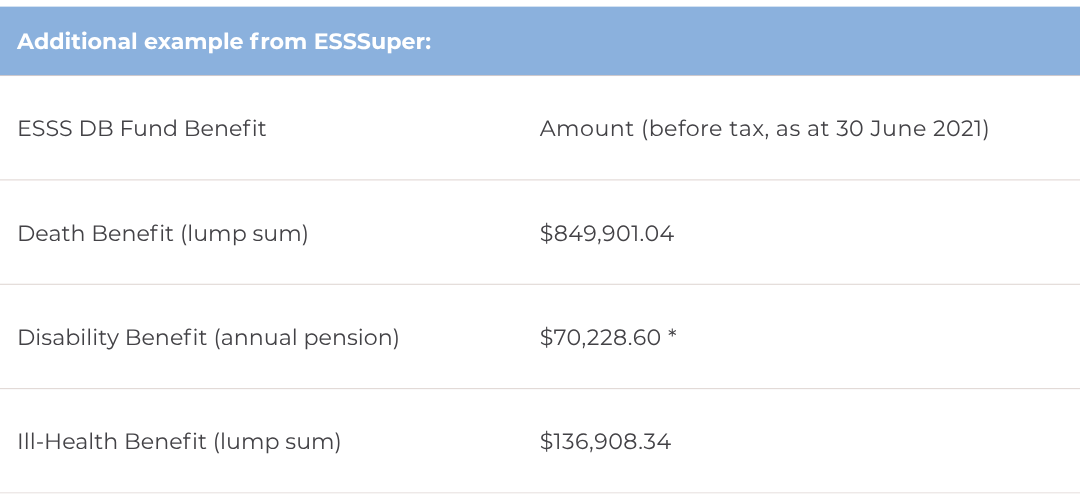

Defined benefit superannuation funds are rare, old-school, and often misunderstood. Unlike your regular super that moves with the market, these funds lock in your retirement payout using a fixed formula.

“In a defined benefit fund, your retirement payout is calculated using your average salary, years of service, and employer contributions — not market performance.”

Source: ESSSuper Defined Benefit Guide

If you're in the public sector or joined one of these funds years ago, you might be sitting on a superannuation goldmine.

What is a defined benefit fund?

In a defined benefit superannuation fund, your retirement benefit is calculated using a fixed formula, not your account balance.

That formula usually looks something like this:

So even if the market crashes, your payout stays the same — because it’s locked in by that formula.

Most defined benefit funds are corporate or public sector like ESSSuper, UniSuper (for older members), or PSS/CSS. Many are now closed to new members.

Defined benefit super and insurance: What’s already included?

Most defined benefit super funds automatically come with insurance benefits built in especially for total and permanent disability (TPD) and death.

That means you might already have some cover sitting there whether or not you asked for it.

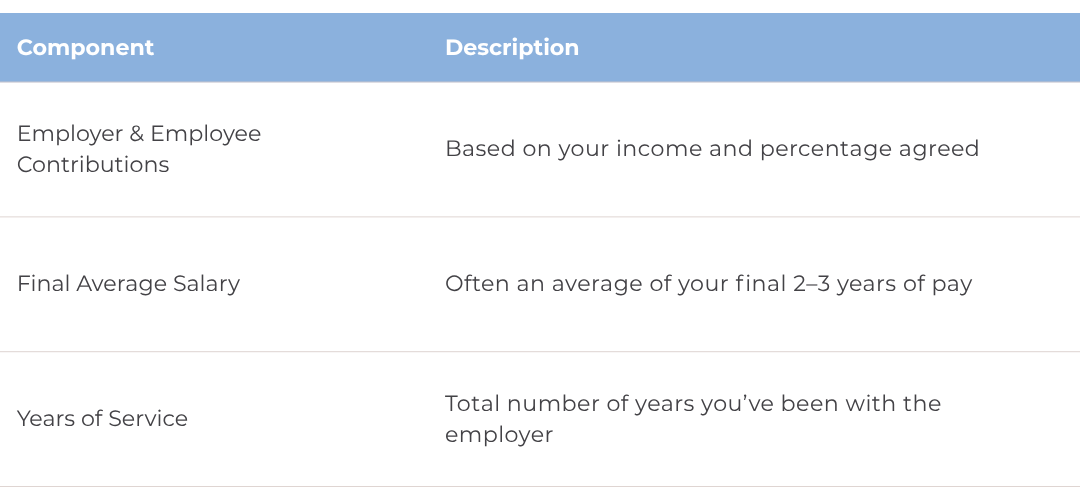

Example: ESSSuper’s defined benefit fund includes a disability benefit of approximately $70,000 per year, payable as a pension if you're considered totally and permanently disabled under an any occupation definition.*

“Defined benefit funds often include TPD-style pensions that pay out monthly if you’re deemed totally and permanently disabled.”

Source: ESSSuper Defined Benefit Guide

And because these are baked into the fund, you usually can’t tweak or cancel them. Which is why we’re often recommending clients retain their existing cover instead of replacing it.

What’s actually covered?

Let’s break it down:

So do you need more cover?

If your income protection needs are short-term, like time off for surgery or mental health, your defined benefit cover might not pay. It’s usually only triggered by total and permanent disability.

“The TPD benefit in your defined benefit fund will only pay if you’re permanently unable to work.”

Source: ESSSuper Defined Benefit Guide

Strategy: Two Paths You Can Take

When we’re working with clients who have defined benefit funds, we usually look at two strategies:

Option 1: Add a full retail income protection policy

This gives you short-term cover for illness or injury, things your defined benefit won’t pay for.

Disclaimer: If you're declared totally and permanently disabled, your defined benefit fund may start paying you a TPD pension. That income could offset what your insurer owes you under an income protection claim.

Still, having income protection in place gives you a backup plan for when you're off work but not fully disabled.

This option makes the most sense if you go with a policy that includes own occupation cover long-term (like those from MetLife).

Option 2: Add a 5-year benefit income protection policy

If your main concern is covering medium-term illness or injury, and you’re comfortable relying on your defined benefit after that, a 5-year policy can do the trick.

“Many clients on claim longer than 5 years are considered permanently disabled, which means the defined benefit kicks in.”

Source: APRA - Annual Fund-Level Super Stats

Option 3: No new income protection

You could decide to rely on your defined benefit TPD alone. It’ll be cheaper, but comes with risk. What if you’re off work for months but not declared TPD?

A quick note on your needs analysis

If you're preparing or reviewing your insurance plan, and you have a defined benefit fund:

Put $0 under super for death if the benefit already includes the super balance.

List TPD as $0 lump sum if it pays a pension instead.

Put the annual pension value into the income protection field (monthly equivalent).

And if you’re ever unsure, talk to your financial adviser or get in touch with the insurer.