Insurance inside vs outside super: What you need to know

Why how you own insurance matters

Most Australians have some form of insurance through super, but not everyone knows how it actually works.

The way your insurance is structured, whether inside or outside super, affects how much you pay, what tax benefits you get, and how easy it is to claim later.

“The structure of your insurance determines not just how it’s funded, but what you actually receive at claim time.”

Life, Total and Permanent Disability (TPD), trauma, and income protection can all be owned in different ways. Each structure has benefits and drawbacks that can make a real difference in both your pocket and your protection.

What sits inside super and what sits outside

Let’s start with the basics.

Life insurance and TPD can be owned inside or outside super.

Income protection can also be held in either structure.

Trauma insurance must always sit outside super because of legislation under the Superannuation Industry (Supervision) Act 1993.

When held inside super, your premiums are usually deducted from your super balance. That helps cash flow, but it also means your benefits may be restricted by superannuation rules when you need to claim.

When owned personally (outside super), premiums come directly from your bank account, but the claim definitions are often broader and payouts go directly to you.

Super-linked policies: the best of both worlds

Super-linking (also called policy splitting) means owning part of a policy inside super and part outside.

It lets you take advantage of both sides: cash flow relief through super and better definitions outside.

For example, a TPD Super-Linked structure keeps the basic cover inside super but adds an external policy that uses the Own Occupation definition. That allows you to claim if you can’t work in your specific job, not just any job.

“Super-linking is about balance. You’re using the super system to your advantage without giving up flexibility.”

This structure can also apply to income protection, where part of the policy is funded through super but a smaller component sits outside.

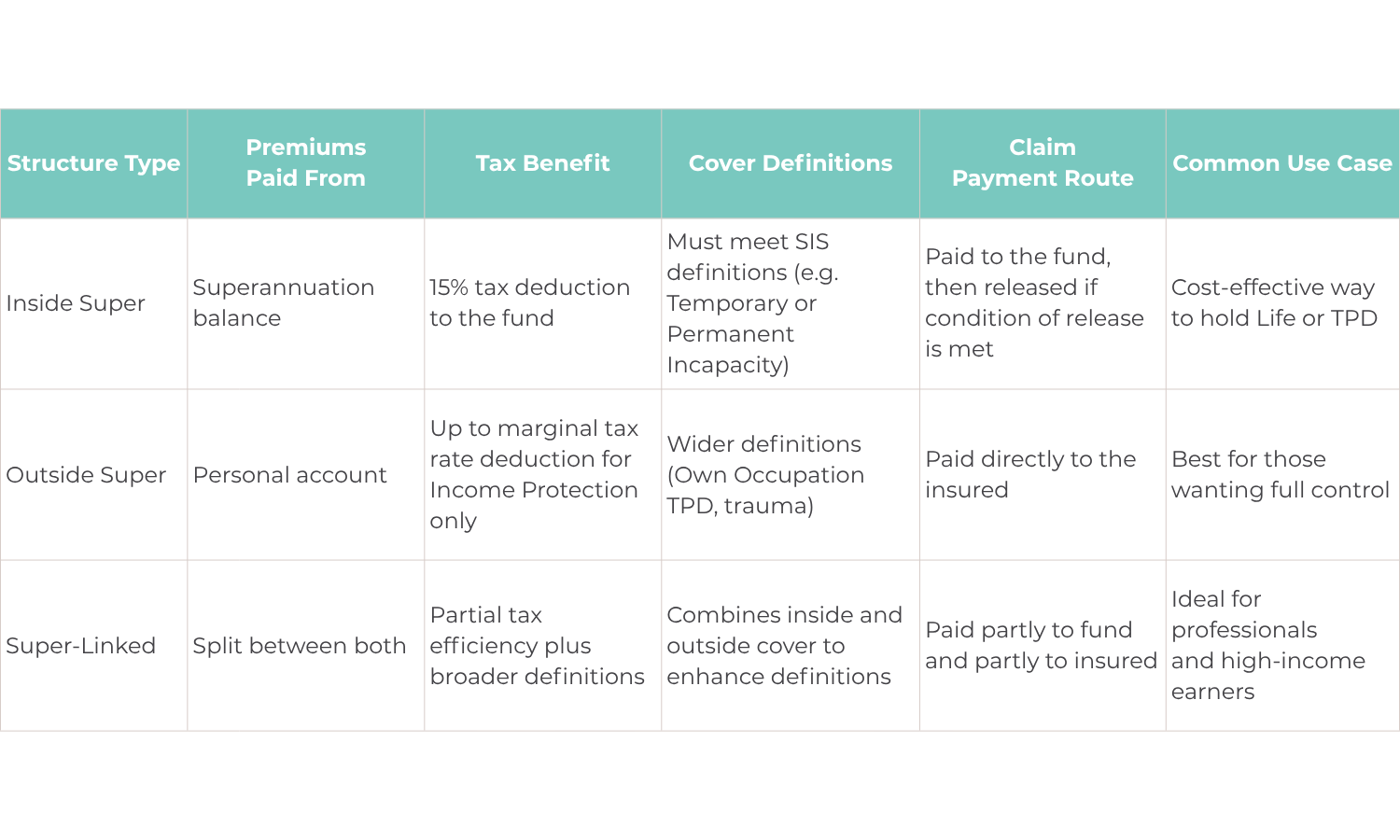

Inside vs Outside vs Super-linked

(Source: APRA, 2024; ATO, 2024)

Tax differences and what they mean

Tax treatment is one of the main reasons people choose to hold insurance inside super.

Super funds can claim a 15% tax deduction on eligible premiums, which effectively lowers your net cost.

If you hold income protection outside super, you can claim the premium as a personal tax deduction at your marginal rate.

That’s more beneficial if you earn a higher income but less useful if cash flow is tight.

For TPD claims inside super, the payout may be subject to tax because it passes through the fund before being paid to you. The tax rate depends on your age and how long you’ve been a member of the fund (ATO, 2024).

By contrast, TPD claims outside super are paid tax-free directly to the insured person.

Claim definitions: why they matter more than you think

One of the most significant differences between owning insurance inside or outside super lies in how claims are assessed.

Inside super, insurers must apply the SIS definitions, for instance, to receive a TPD payment, you must be deemed permanently incapacitated for any occupation you are reasonably suited to by education, training or experience.

Outside super, the definition is more flexible. You can often claim under the Own Occupation rule, meaning you are covered if you can no longer work in your specific job.

That difference can be life-changing. A surgeon who loses dexterity might not qualify under an “any occupation” definition but would likely be paid under an “own occupation” definition.

The unemployment gap: why some policies offer backup cover

If your income protection policy sits entirely inside super, there is one catch: you must meet the SIS definition of Temporary Incapacity to receive benefits.

That means you need to have been gainfully employed at the time you became disabled.

If you were between jobs, or had just left one role and not yet started another, the claim could be declined.

To close that gap, several insurers such as Acenda, ClearView, Zurich, AIA, MetLife, and Encompass automatically include what is known as a Certificate of Insurance for Disability While Unemployed or Complimentary Income Protection Outside Super.

These add-on benefits are separate policies that sit outside super and activate only if you become disabled while unemployed.

“If you become disabled while unemployed, the insurer can assess your claim under the certificate even though your main policy is held in super.”

This additional cover is provided at no extra cost and ensures that you are still protected between jobs.

Why Skye often recommends super-linking

At Skye, the philosophy is about balance — protecting clients’ cash flow while keeping the strength of cover definitions that matter most at claim time.

Life and TPD are usually structured through super for efficiency, but the TPD component is often super-linked to include stronger definitions outside super.

This setup means clients still benefit from the 15% super tax deduction while keeping the flexibility of broader claim definitions.

Income protection follows a similar logic. For clients earning over $190,000 a year, policies are usually held outside super to maximise personal tax deductions.

For everyone else, super-funded or super-linked policies often make more sense financially.

“The goal is to make cover sustainable for the long term. There’s no point having great definitions if you can’t afford to keep the policy.”

Example: the surgeon and the teacher

Case 1: The surgeon

A surgeon earning $300,000 a year holds income protection outside super. The higher marginal tax rate means the tax deduction on premiums lowers the net cost. They also have TPD structured as super-linked, allowing an own occupation claim if they can no longer perform surgery.

Case 2: The teacher

A schoolteacher earning $85,000 holds life and TPD inside super and income protection through a super-linked policy. Most premiums are funded from the super balance, keeping cash flow manageable. The outside portion ensures a claim can still be paid if they become disabled while between jobs, and if eligible, can also allow for an own occupation claim.

Both cases highlight the balance between affordability, flexibility, and protection that lasts.

Key takeaway

Insurance structure is not just paperwork. It affects how much protection you have, how claims are paid, and what you actually receive after tax.

If you are setting up or reviewing your cover, ask your adviser:

Is my insurance inside or outside super?

What definitions apply at claim time?

Would super-linking make my policy stronger or cheaper?

“It’s about building insurance that works not just today, but years from now when you really need it.”

Resources

Australian Taxation Office (ATO, 2024): Tax treatment of insurance through superannuation https://www.ato.gov.au

APRA (2024): Life Insurance Claims and Disputes Statistics

MoneySmart (2024): Insurance through superannuation explained