Women and wealth: how to boost your financial confidence

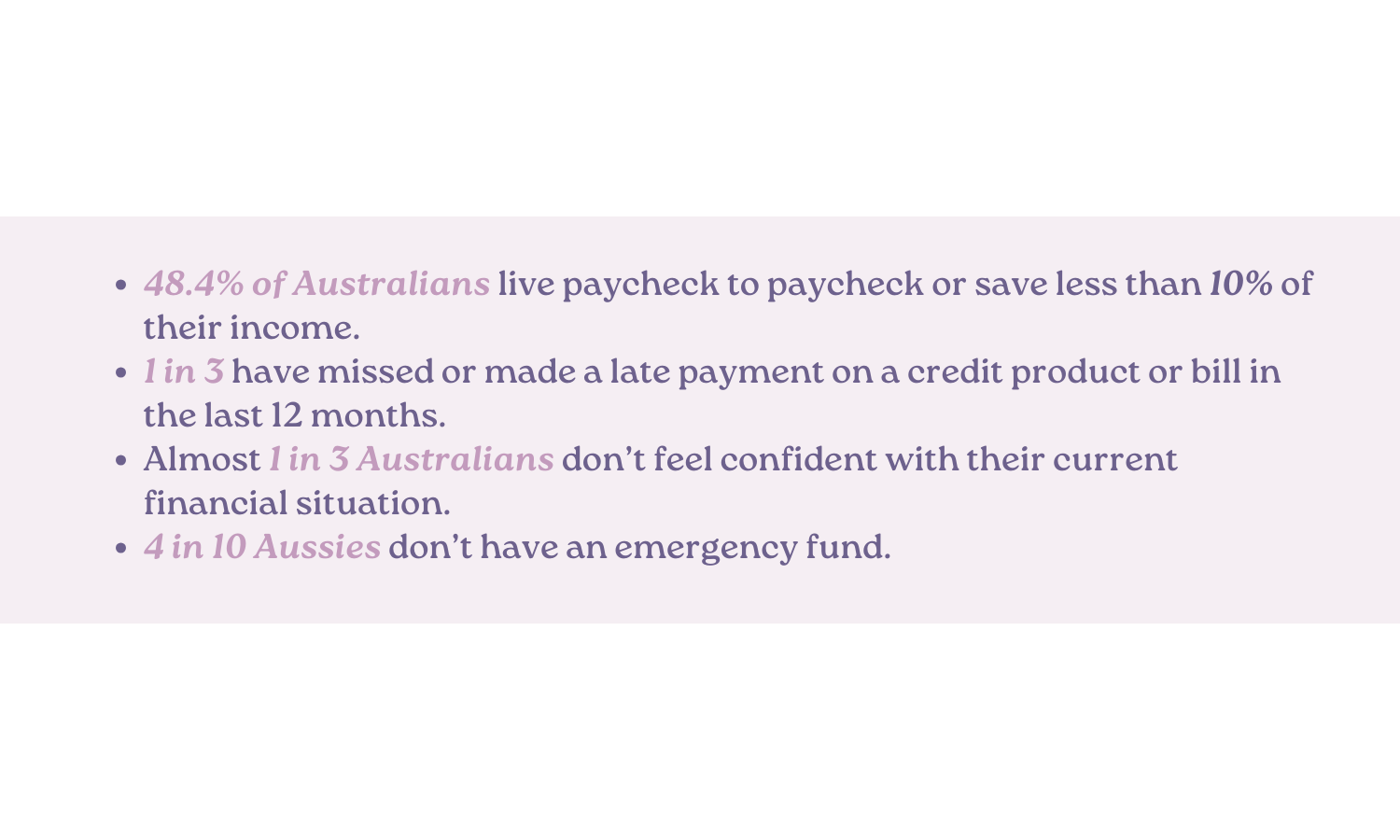

If the mere mention of money management makes you break into a cold sweat, you're not alone. According to the WeMoney Financial Wellness Survey conducted from 2021 to 2022, nearly half of Australians are living paycheck to paycheck or saving less than 10% of their income. That's a staggering statistic that hits close to home for many of us. In the same survey, it shows that one in three Aussies have missed or made late payments on credit products or bills within the past year.

Financial anxiety is at an all-time high, with many feeling uncertain about their money matters. To add fuel to the fire, a concerning 40% of Aussies don't even have an emergency fund to fall back on.

It turns out that women are shouldering a significant portion of this financial burden. Recent reports reveal that women are "significantly more likely" to live paycheck to paycheck compared to men. In fact, 59% of women find themselves in this precarious position, highlighting the urgent need for change.

But hey it's time to rewrite the narrative and empower ourselves to take control of our financial destinies.

Here are some tips on how to kickstart your financial journey with confidence:

Assess your net worth

Your net worth is like the financial report card of your life. It's the sum of all your assets, like savings, investments, and property, minus any debts you owe, such as loans or credit card balances. Understanding your net worth gives you a bird's-eye view of your financial health and helps you pinpoint areas for improvement.

Knowing the value of your assets is crucial for grasping your net worth, which, in turn, guides various financial decisions, from planning your budget to strategising for the future and even considering loans or estate planning.

Here are some questions to ponder:

Are you grappling with high-interest debt like credit cards or personal loans? If so, it's time to devise a strategy to pay it off pronto.

Have you built up a financial safety net of three to six months' worth of expenses? If not, consider making it a priority to squirrel away funds for emergencies. Even starting with a modest amount like $25 or $50 per month can set you on the right path.

Reflect on your current savings habits. Are you stashing away a consistent amount each month? Challenge yourself to up the ante by an extra 5 or 10 percent if possible.

If you're in a relationship, it's crucial for both you and your partner to stay in the loop about your individual and joint financial standings. Consider scheduling regular "money dates" to review your spending, saving, and joint goals, ensuring you're both aligned on the path to financial success.

Embrace the world of investing

Inflation can eat away at the value of your money over time, so relying solely on saving isn't enough to meet your long-term financial goals. While savings accounts offer minimal interest rates, they often lag behind the rising cost of living, gradually diminishing your purchasing power.

Investing, on the other hand, presents an opportunity for your money to grow. While women tend to approach investing more cautiously than men, this cautiousness can be an advantage in the grand scheme. Consistently investing even small amounts over time can yield significant returns.

As a bonus, here's a book recommendation to ignite your investing spirit:

"Don't Stress, Just Invest!" by Alec Renehan & Bryce Leske

This book offers a straightforward approach to investing, emphasising the simplicity of automated, regular investing as a path to building wealth without the need for a finance background or extensive screen time.

Expand your financial know-how

Feeling a bit shaky on debt management, investing, or how to handle life's unexpected twists and turns? There's a wealth of knowledge waiting for you to tap into!

Connect with a financial adviser for personalised guidance on your financial journey. They can help you assess where you stand and chart the best course forward.

Tune into financial podcasts during your commute or workout sessions. Look for shows dedicated to personal finance or financial wellness on your favourite podcast platform. It's like having a money-savvy friend in your ear, dishing out expert advice whenever you need it.

We highly recommend checking out "She's On The Money" hosted by Victoria Devine. This podcast is your go-to source for millennial money expertise, sharing tips for financial freedom. You can find it on Apple Podcasts or your preferred podcast platform.

And lastly, Join a book club focused on personal finance to exchange insights and ideas with like-minded individuals. Check out your local library or Meetup groups for existing book clubs, or take the plunge and start your own.

Budget, budget, budget

First up, identify your expenses. Sort them into fixed and variable categories, and don't forget to distinguish between your needs and wants. Needs, like housing and groceries, should take priority over wants, such as that shiny new gadget or a luxury vacation.

Fixed expenses are the stalwarts that remain the same month after month, like rent or car payments. Variable expenses, on the other hand, can fluctuate, like your grocery bill or entertainment expenses.

If you can find ways to trim down those fixed expenses, like hunting for a more budget-friendly apartment or switching to a cheaper phone plan, you'll free up cash in your budget month after month. As for variable expenses, a little mindfulness goes a long way. Keep tabs on your spending, whether it's at the grocery store or when you're out on the town, and watch those savings add up over time. It might require some ongoing attention, but the payoff is well worth it!