She's got the money: Empowering women and their finances through every life stage

Alright, ladies, listen up! We all know that juggling act called life, right? Well, turns out, when it comes to bossing it in the multitasking department, women are absolute pros! From running households to crushing it in careers, from nurturing families to supporting friends, women sure know how to do it all.

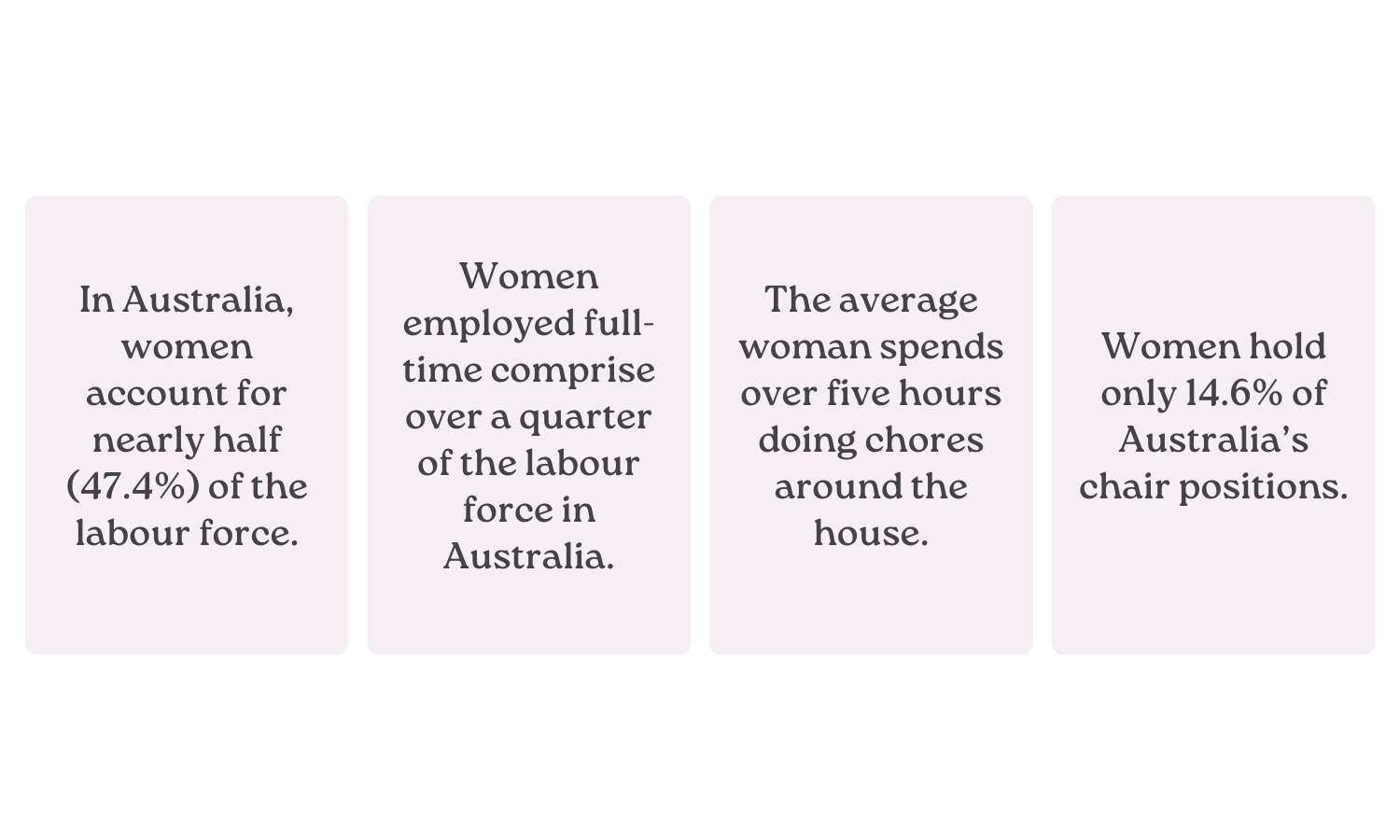

But while we're smashing glass ceilings left and right, let's talk about another area where we're kicking goals: our finances! According to Accumulate Australia, almost half of the Aussie workforce is made up of women — talk about girl power! 🌟 But hey, despite the strides we've made, there's still some ground to cover. Take the gender pay gap, for instance. It's been shrinking since '80, but even in 2024, women are still earning on average less than men.

Source: Workplace Gender Equality Agency

-Katy Gallagher | Australia's Minister for Women

Let's talk dollars and sense

Turns out, research says women are not diving into finances like they should, which can make saving and investing a bit of a headache. According to MetLife's Annual Employee Benefits Trend Study, women feel less confident about their money game as the guys (55% vs. 70%) and are more likely to be counting down to payday (44% vs. 55%).

Source: Accumulate Australia

But hey, it's not all gloom and doom! When we take the reins on our money matters, magic happens. Seriously, being in control of our cash flow means we can steer it towards our dreams. Sure, it might feel like diving into the deep end of a pool, but trust us, once you start paddling, you'll find your stroke. It's all about a little learning, a lot of doing, and before you know it, you'll be the queen of your financial castle!

Tips for every age

Here are some tips tailored to each stage of life to boost women's financial confidence and independence for the long haul.

Age: 20s

Possible life milestones: College years, first jobs, saying "I do"

College

So, here's the scoop: women are totally owning the college game, earning about 57% of all bachelor's degrees, according to Pew Research Center. But hey, college isn't just about the parties and late-night cram sessions – it's also about setting yourself up for financial success. With student loans soaring, it's crucial to have a plan to tackle that debt head-on.

Source: ABS Census

Career kick-off

Once you land that first gig, jump on any company-sponsored retirement plans – especially if there's a match. And hey, while you're at it, stash away some emergency cash and tackle any pesky debts like a boss. Your future self will thank you for it. 💸

See what to do with your first paycheck here.

Marriage

if you're thinking about tying the knot (totally your call)—apparently, the average age for women to get hitched in 2022 was around 28, according to stats—it's vital to keep tabs on your cash flow, even when you're a duo.

Try divvying up your money with separate checking accounts and credit cards, alongside shared ones. And hey, why not pencil in a monthly chat about your money moves? It's all about teamwork when it comes to those financial goals! Because love is grand, but so is financial freedom. 💍

Age: 30s

Possible life milestones: Starting a family/parenthood, home ownership decisions

Starting a family?

Babies are a bundle of joy, but let's be real, they can also be a big expense. If you're planning to take some time off work, make sure you've got a solid plan in place to keep your finances ticking over. Check out all your maternity leave options to maximise your benefits.

And hey, stash away a little extra in your emergency fund while you're expecting. You never know when those unexpected costs might pop up! Oh, and don't forget to give your health insurance a once-over to make sure it's got you covered when you need it most.

Read about financial nesting when pregnant here.

Deciding whether to rent or buy your first house

Renting or buying? It's a big decision. Sure, buying can be a smart investment, but there's more to it than just the price tag. Think taxes, maintenance, and even Private Mortgage Insurance if you're not dropping a 20% down payment. Remember, stay within your means and don't bite off more than you can chew.

When you're gearing up to buy your dream home, it's smart to connect with a broker right off the bat. Brokers are licensed pros and ready to navigate the borrowing maze with you. From determining your borrowing power to sorting out how much deposit you'll need, they've got your back. Brokers can also dish out valuable nuggets about various lender options and even give pointers on beefing up your credit score, which can be a game-changer when it comes to snagging that dream home. By working with a broker, you can have access to expert advice and support throughout the home buying process.

Factors to consider

For several costs to consider when purchasing a home, read here.

Age: 40s

Possible life milestones: Funding college, career growth, estate planning

College funds

Entering your 40s can mean you’re juggling a lot—family, career, and financial goals. If you've got kids, you might be eyeing that college fund, but it's also important not to sacrifice your retirement savings for it. Sure, starting early in a college plan can grow your funds, but not at the expense of your golden years.

Source: Money

Bossing the career scene

Now, if you're riding the career wave and snagging those promotions left, and right, kudos! With the big bucks rolling in, it's time for a financial check-up. Emergency savings, retirement funds, and college accounts—they all need your attention. Make sure your assets are spread out wisely.

Sorting out your legacy

And hey, have you thought about your legacy? Yup, estate planning. It's not just for the rich and famous. It's for folks like you and me who want to make sure our stuff goes where we want it to go when we're no longer around. Especially crucial if you’ve got a family to look after.

Curious about estate planning? Know more about it here.

Age: 50s

Possible life milestones: Time for an empty nest, eldercare, planning retirement dreams

Ramping up retirement savings

Ah, the golden years! As your kids fly the coop and you start thinking about retirement, it's time to ramp up those retirement savings.

First up, supercharge those retirement savings—now's the prime time to really beef up that nest egg before you kick back for good. With the kids out and about, you might find yourself with some extra space at home. Ever considered downsizing? It's a smart move to free up some extra cash to funnel into your retirement pot. Plus, if your kiddos have already graduated, maybe it's time to redirect those college fund dollars right into your own future!

Caring for aging parents

While your own kids might be out living their best lives, you might find yourself stepping into the role of caregiver for your aging parents. It's a common scenario, with studies showing that folks between 55 and 64 are often on the frontlines of eldercare, especially you strong women out there! But hey, don't forget about yourself during all the caregiving chaos. There are heaps of resources out there to lend a hand. From financial aid to low-cost services, places like the National Association of Area Agencies on Aging and Eldercare can be real lifesavers. Just remember, while you're looking after others, don't forget to look after number one—aka, you!

Age: 60s

Possible life milestone: Retirement

Living the dream: Making retirement years count

Retirement might be the moment you've been waiting for, the golden years when you can finally kick back and relax. But before you dive headfirst into that beach chair, it's time to get serious about your retirement strategy. Understanding how your savings will translate into steady income is key, along with figuring out what hobbies and activities will keep you buzzing with excitement. Plus, here's a fun fact: According to the World Health Organization, women tend to outlive men by about six to eight years, so it's all about stretching those retirement dollars for the long haul.

Today's women are rocking opportunities that were once just distant dreams. To make the most out of every chapter in your life, it's crucial to stay savvy about your financial goals and needs, always ready to adjust course when needed. After all, life's all about seizing those opportunities and making them count!